Nationwide Unpaid Wage Lawyers

Fighting for Workers’ Rights from Coast to Coast

When your employer does not pay for all the hours that you work, they are betraying not only their duties under the law but also you.

If you’ve found yourself in a situation where you are not being paid fairly, it’s hard to know where to turn to for help.

At Josephson Dunlap, we understand what you are going through, and we are here to guide you every step of the way as we fight to get all your hard-earned money back.

Our unpaid wage lawyers have stepped in and helped many others stand up against their employers, and we want to help you, too.

Our unpaid wage attorneys are laser-focused on getting back what you are owed. We believe our clients deserve their fair pay, and we will stop at nothing to reclaim what was lost.

To date, our firm has:

Our team at Josephson Dunlap knows how to navigate the legal system, and we are committed to being the tireless advocate you need.

For a free, no-obligation consultation, call (888) 992-2990 or contact us online, and a member of our team will get back to you shortly. Se habla español.

Can You Sue for Unpaid Wages?

Unpaid wages can leave any hardworking employee feeling frustrated and undervalued. If you've found yourself in a situation where your employer has failed to pay you the wages you're owed, you may be wondering if you have any legal recourse.

The answer is yes; you can sue your employer for unpaid wages.

However, this process can be complex, requiring representation from an unpaid wage lawyer who has a thorough understanding of relevant employment laws and regulations. An attorney from Josephson Dunlap can help you navigate this difficult situation and work to ensure that you receive the compensation you deserve.

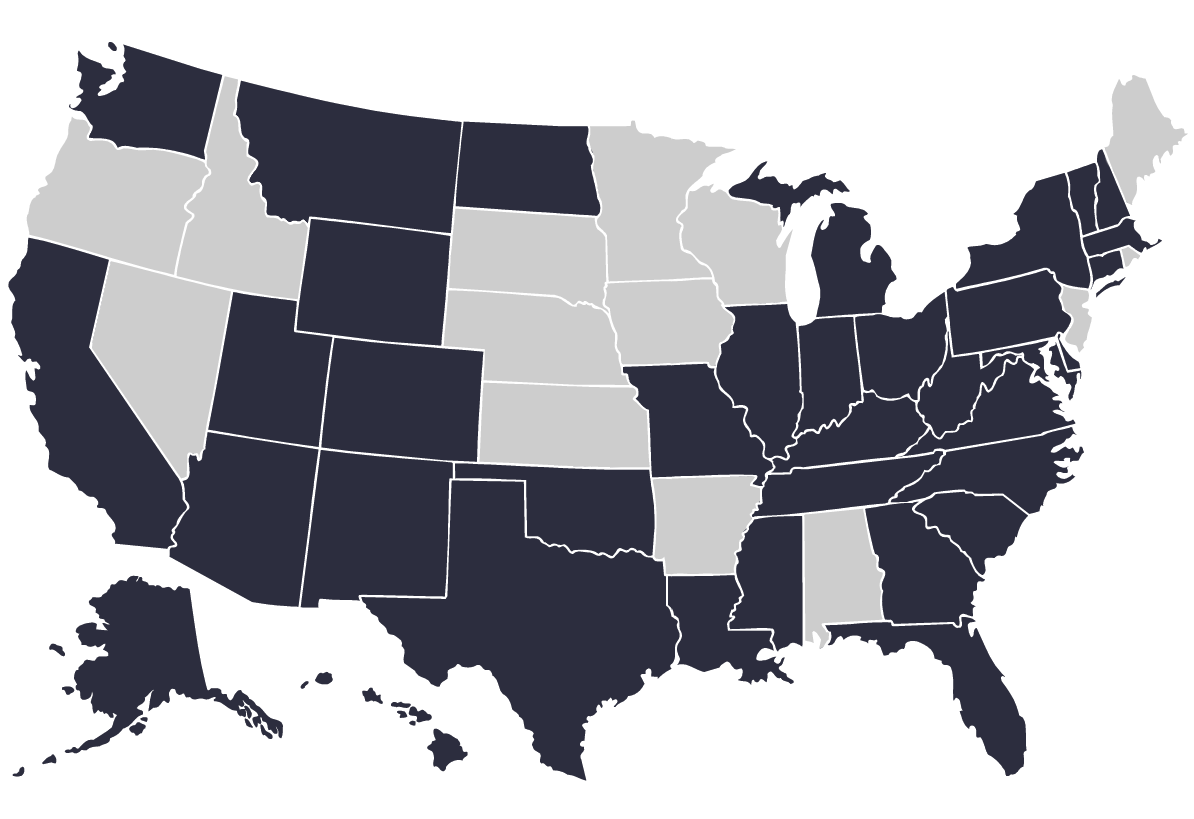

Washington

- Statute of Limitations: 3 years

- Min. Wage: $16.28/hour

- State Law: Washington has both "Rest Break" and "Paid Sick Leave" laws that other states do not have and that the FLSA does not require!

Oregon

- Statute of Limitations: 3 years

- Min. Wage: $12.00/hour

- State Law: Oregon has Predictable Scheduling Laws that protect its workers from erratic and ever-changing work schedules!

California

- Statute of Limitations: 4 years

- Min. Wage: $16.00/hour

- State Law: California requires employers to not only pay overtime for hours in excess of 40 in one work week, but also hours in excess of 8 hours within one 24-hour period. Furthermore, cities such as Los Angeles and San Francisco have even higher min. wages and additional benefits!

Idaho

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Idaho follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Montana

- Statute of Limitations: 3 years

- Min. Wage: $10.30/hour

- State Law: Montana also follows the federal Fair Labor Standards Act (FLSA) for most of its labor laws. However, Montana requires that certain public employers provide overtime pay to employees who work more than 40 hours in a workweek.

Nevada

- Statute of Limitations: 3 years

- Min. Wage: $10.50/hour

- State Law: In Nevada employees must be paid one and a half times their regular rate for hours worked over 8 in a 24-hour period and over 40 in a week. Nevada law requires daily overtime pay and provides greater protections than the FLSA in certain scenarios.

Arizona

- Statute of Limitations: 3 years

- Min. Wage: $14.35/hour

- State Law: Arizona follows the federal Fair Labor Standards Act (FLSA) for most of its labor laws. However, certain municipalities, such as Flagstaff or Tucson, offer higher minimum wage protections for workers.

Arkansas

- Statute of Limitations: 3 years

- Min. Wage: $11.00/hour

- State Law: Arkansas follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Colorado

- Statute of Limitations: 3 years

- Min. Wage: $14.42/hour

- State Law: Certain cities, such as Denver, offer a higher minimum wage than mandated by the state and requiring employers to pay overtime to those who work more than 12 hours in a workday. Colorado also has specific rules for meal and rest breaks and provides paid sick leave.

Connecticut

- Statute of Limitations: 3 years

- Min. Wage: $15.69/hour

- State Law: Connecticut’s Public Act 19-4, signed in 2019, schedules annual minimum wage increases for five years, then ties further increases to the employment cost index.

Delaware

- Statute of Limitations: 3 years

- Min. Wage: $10.50/hour

- State Law: Delaware follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

District of Columbia

- Statute of Limitations: 3 years

- Min. Wage: $17.00/hour

- State Law: DC has one of the most worker-friendly wage and hour laws in the country. In certain scenarios, employees could recover up to 4 times what they are owed in unpaid and late wages!

Florida

- Statute of Limitations: 3 years

- Min. Wage: $12.00/hour

- State Law: Florida follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Georgia

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Georgia follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Hawaii

- Statute of Limitations: 2 years

- Min. Wage: $14.00/hour

- State Law: Hawaii follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Illinois

- Statute of Limitations: 5 years

- Min. Wage: $14.00/hour

- State Law: Chicago is one of the few places and municipalities in the country offering Fair Workweek protections for work schedules. Illinois also offers additional protections for meal and rest breaks, sick leave and equal pay!

Indiana

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Indiana follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Iowa

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Iowa follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Kansas

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Kansas follows the federal Fair Labor Standards Act (FLSA) for its labor laws. Employers are required to pay employees at one and a half times their regular rate after 40 hours in a workweek.

Kentucky

- Statute of Limitations: 5 years

- Min. Wage: $7.25/hour

- State Law: Kentucky follows the federal Fair Labor Standards Act (FLSA) for its labor laws. Employers are required to pay employees at one and a half times their regular rate after 40 hours in a workweek.

Louisiana

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Louisiana follows the federal Fair Labor Standards Act (FLSA) for its labor laws. Employers are required to pay employees at one and a half times their regular rate after 40 hours in a workweek.

Maine

- Statute of Limitations: 6 years

- Min. Wage: $13.80/hour

- State Law: Maine follows the federal Fair Labor Standards Act (FLSA) for its labor laws. Employers are required to pay employees at one and a half times their regular rate after 40 hours in a workweek. Maine does however have laws that protects meal and rest periods for workers.

Maryland

- Statute of Limitations: 3 years

- Min. Wage: $15.00/hour

- State Law: In June 2021, Maryland passed the Secure Maryland Wage Act, which boosts the minimum wage to $13.50 per hour for workers at high-security locations like BWI Airport and Pennsylvania Station. This law, with its annual increases, aims to reduce turnover and attract essential workers like janitors, security officers, ramp workers, and ticket agents.

Massachusetts

- Statute of Limitations: 3 years

- Min. Wage: $15.00/hour

- State Law: Massachusetts requires daily overtime for certain industries. Additionally, Massachusetts has meal break laws, paid sick leave, and regulations that protect retail workers on Sundays and holidays.

Michigan

- Statute of Limitations: 3 years

- Min. Wage: $10.33/hour

- State Law: Michigan follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA. However, Michigan has paid sick leave laws and specific provisions for meal and rest breaks.

Minnesota

- Statute of Limitations: 3 years

- Min. Wage: $10.85/hour

- State Law: Minnesota follows the federal Fair Labor Standards Act (FLSA) for its labor laws but also has additional state-mandated overtime laws. Minnesota requires paid sick leave in certain cases and provisions for meal and rest breaks.

Mississippi

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Mississippi follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Missouri

- Statute of Limitations: 2 years

- Min. Wage: $12.00/hour

- State Law: Missouri follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Nebraska

- Statute of Limitations: 3 years

- Min. Wage: $12.00/hour

- State Law: Nebraska follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

New Hampshire

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: New Hampshire follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

New Jersey

- Statute of Limitations: 6 years

- Min. Wage: $15.00/hour

- State Law: New Jersey prohibits healthcare facilities from requiring direct patient care workers to work overtime, except in emergencies, thus preventing excessive work hours for healthcare workers. Additionally, New Jersey has paid sick leave laws and requires overtime pay for hours worked over 40 in a workweek.

New Jersey

- Statute of Limitations: 6 years

- Min. Wage: $15.00/hour

- State Law: New Jersey prohibits healthcare facilities from requiring direct patient care workers to work overtime, except in emergencies, thus preventing excessive work hours for healthcare workers. Additionally, New Jersey has paid sick leave laws and requires overtime pay for hours worked over 40 in a workweek.

New Mexico

- Statute of Limitations: 3 years

- Min. Wage: $12.00/hour

- State Law: New Mexico has specific rules for meal and rest breaks. Additionally, some municipalities, like Santa Fe, have higher minimum wage rates and additional worker protections.

New York

- Statute of Limitations: 6 years

- Min. Wage: $15.00/hour

- State Law: New York law prohibits agreements to waive overtime pay for non-exempt workers, deeming such agreements illegal and unenforceable. New York also has paid sick leave laws, predictive scheduling laws, and specific protections for various industries.

North Carolina

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: North Carolina follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

North Dakota

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: North Dakota follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Ohio

- Statute of Limitations: 3 years

- Min. Wage: $10.45/hour

- State Law: Ohio follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Oklahoma

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Oklahoma follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Pennsylvania

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: In Pennsylvania, time on employer-provided shuttles or transportation (e.g., from a parking lot to the workplace) is considered as time to be paid for. Pennsylvania’s wage and hour laws provide greater protection than the FLSA in certain scenarios.

Rhode Island

- Statute of Limitations: 3 years

- Min. Wage: $14.00/hour

- State Law: In Rhode Island, if you work on Sundays or certain holidays, you are entitled to be paid 1.5 times your regular hourly wage. This rule applies to eligible employees in specific industries such as retail and hospitality.

South Carolina

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: South Carolina follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

South Dakota

- Statute of Limitations: 3 years

- Min. Wage: $10.80/hour

- State Law: South Dakota follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Tennessee

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Tennessee follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Texas

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Texas follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Utah

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Utah follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Vermont

- Statute of Limitations: 3 years

- Min. Wage: $13.67/hour

- State Law: In Vermont, you may be eligible to receive compensatory time off in lieu of overtime pay, but this is only permissible if there is a written agreement in place beforehand. This agreement must be established between the employer and the employee to comply with legal requirements.

VIRGINIA

- Statute of Limitations: 3 years

- Min. Wage: $12.00/hour

- State Law: Effective July 1, 2021, the Virginia Overtime Wage Act (VOWA) includes provisions that may differ slightly from the FLSA, such as specific calculation methods for employees who receive bonuses or commissions.

West Virginia

- Statute of Limitations: 3 years

- Min. Wage: $8.75/hour

- State Law: Nurses in West Virginia cannot be mandated to work overtime unless during an emergency situation and they also cannot work more than 16 hours in one 24-hour period.

Wisconsin

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Wisconsin state requires overtime pay for hours worked over 40 in a workweek. The state also has specific provisions for meal and rest breaks and provides paid sick leave.

Alaska

- Statute of Limitations: 3 years

- Min. Wage: $11.73/hour

- State Law: Alaska follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Alabama

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Alabama follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

Wyoming

- Statute of Limitations: 3 years

- Min. Wage: $7.25/hour

- State Law: Wyoming follows the federal Fair Labor Standards Act (FLSA) for its labor laws. There are no additional state-mandated overtime laws beyond what is required by the FLSA.

On behalf of workers like you; we lead legal battles against employers who cheat their workers out of wages.

10+

Attorneys

1,800+

Cases Filed Nationwide

100,000+

Workers Helped

MILLIONS

Recovered in Unpaid Wages

Salaried Workers

It is a common myth that salaried workers do not receive overtime. The Fair Labor Standards Act (FLSA) requires employers to pay all employees who work over 40 hours a week overtime. Even if you are labeled as an exempt employee, there is a high probability that you are incorrectly labeled or misclassified and should still be receiving overtime compensation.

Day Rate Workers

Day rate workers receive a flat sum or a day rate for all of the hours worked in one day. What you may not know is that your employer is required to pay you overtime if you work more than 40 hours per week. If you are a day rate worker, and you are working more than 40 hours per week, call Josephson Dunlap today to start reclaiming your unpaid wages.

Independent Contractors

Independent contractors are employees who are not economically dependent on their employer. They are not paid vacation time, meal breaks, or overtime. They also do not qualify to receive medical insurance from their employer. Unfortunately, employers will misclassify their employees as independent contractors to avoid paying for overtime and other employee benefits. Misclassification of independent contractors happens often, and it could be happening to you.

Hourly Workers

Hourly workers are often not paid for all of the overtime that they work. Many of the basic rights required by law are denied to hourly workers, and therefore, their overtime pay is denied as well. A few of these rights are related to breaks, minimum wage, working off the clock, vacation and time off, illegal wage deductions, and inaccurate wage statements. Each time your rights are denied, it can add up to substantial overtime in back wages that your employer is required to pay to you.

Know Your Rights. Protect Your Wages.

In the United States, workers in all positions and across all industries have numerous rights. These rights are protected by both federal and state laws.

As a worker, it is important that you understand your rights so that you know when an employer has violated them, as well as what to do when this occurs.

In addition to having the right to a workplace that is safe and free from discrimination and harassment, you have the right to receive fair pay for all hours worked. Your employer may not take unlawful deductions from your paycheck, nor may they engage in illegal tip pooling or pay you less than the applicable minimum wage in your state or local area.

Depending on your employment status, you may also have the right to overtime pay, even if you are a salaried employee.

Your right to unpaid leave is also protected under the Family and Medical Leave Act (FMLA), as well as certain other state laws. This means that you can take qualified, job-protected, unpaid FMLA leave without retaliation.

Depending on the state in which you live and work, you may also be entitled to regular meal breaks and rest periods during your shifts.

Perhaps most importantly of all, you should know that you have the right to sue your employer when they violate your rights.

You are allowed to report rights violations—ranging from workplace discrimination and harassment to unpaid wages and overtime—without being retaliated against or disciplined in any way.

If you believe your employer has failed to pay you for hours worked or otherwise violated your rights as an employee, reach out to our team at Josephson Dunlap right away for the legal help you need.

Call (888) 992-2990 to speak with our unpaid wage attorneys. We handle cases nationwide.

Why Clients Trust Us

Experience

Our team of award-winning trial attorneys is dedicated to our clients. We have the staff, the resources, and the significant legal experience to fight for you and your hard-earned wages.

Focus

We have one mission and one mission only: to reclaim lost wages. We are laser-focused on that mission.

Success

We fight for fair pay under the law and don't stop until our clients are paid what they are owed. We have been able to reclaim millions in lost wages for our clients, and we could potentially do the same for you.

Empathy

We are more than lawyers; we are your defenders, and we have dedicated our practice to helping people seek their correct pay under the law.

For more than two decades, our unpaid wage attorneys have helped workers throughout the U.S. stand up to employers who would seek to cheat them out of fair wages.

Our clients include people from all walks of life, including:

We handle all types of claims, including those involving:

No matter the situation you are up against, you can count on our team to fight tirelessly for the fair reimbursement you are owed. Because we are a large, nationwide firm with a long, proven track record of success, we have the necessary resources to effectively pursue these claims.

We view ourselves as more than lawyers; we are your defender, your advocate, and your guide through the legal process. We are proud to dedicate our legal practice to protecting the rights of workers throughout the United States, and we are ready to fight for you.

At Josephson Dunlap, we only have one goal: to help you recover the rightful damages you are owed.

If you have suffered financial loss, psychological distress, or other damages due to an employer’s wrongful conduct, reach out to our nationwide unpaid wage lawyers today to learn how we can help.

Employers use various methods to evade paying for overtime hours. Learn more about these methods and your rights.

It all starts with a consultation. A personal case manager will quickly identify if you have a case. A quick 10-minute phone consultation is all it takes.

"*" indicates required fields