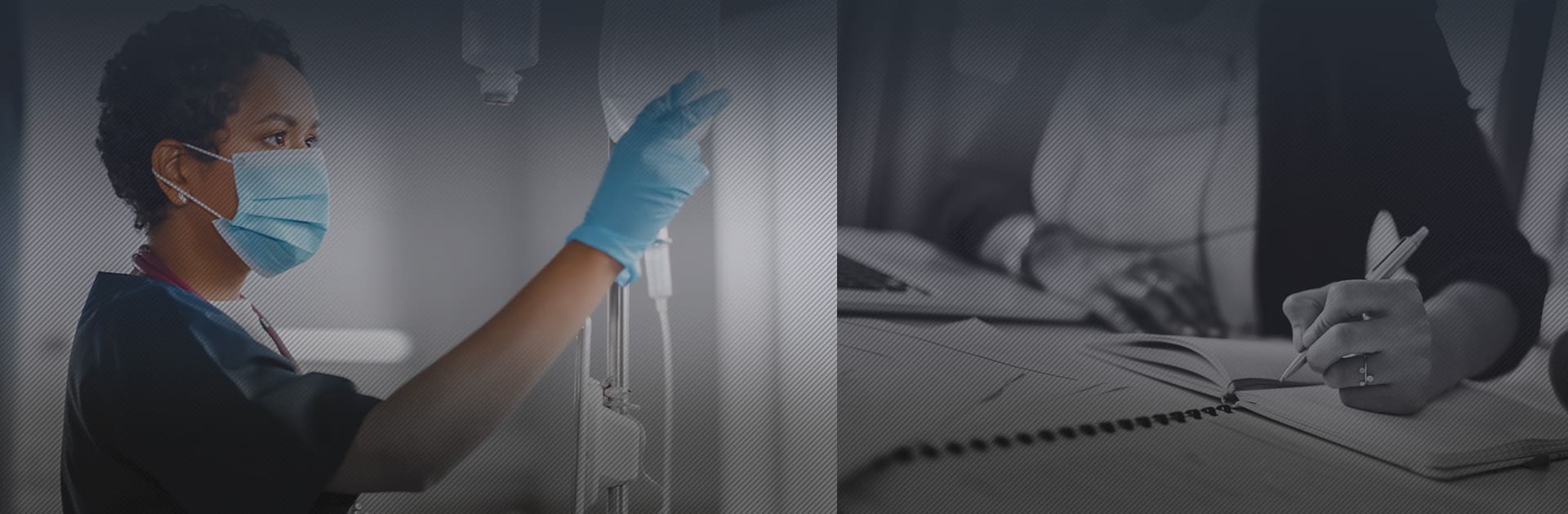

As lawyers for the workers, we make sure that employers pay you for the long hours you put in and give you the wages you are owed.

Off-the-Clock Work Lawyers

Filing a Wage Claim for Unpaid Off-the-Clock Hours

Under U.S. Department of Labor guidelines, any time an employee is required to be on duty, at the workplace, or performing job-related tasks, that time must be counted as hours worked and compensated accordingly.

When employers require or pressure workers to perform tasks before clocking in, after clocking out, or during unpaid breaks, they are violating the law. Off-the-clock work is not only illegal—it’s one of the most common ways employees are denied the pay they’ve rightfully earned.

If your employer has required you to work off the clock—whether explicitly or through pressure or policy—you may have a valid wage and hour claim.

At Josephson Dunlap, we’ve helped over 100,000 workers nationwide recover hundreds of millions of dollars in unpaid wages. We understand the complexities of federal and state labor laws, and we have the experience and resources to fight back on your behalf.

We have the resources to pursue even the toughest of cases. Call (888) 992-2990 or contact us online to schedule a free consultation with our team.

Off-the-clock work refers to any job-related activity you perform for your employer’s benefit without receiving pay. Even if you’re not an hourly employee or don’t physically clock in and out, you may still be working off the clock if you're required to handle tasks outside of your scheduled hours without compensation.

Common Examples of Off-the-Clock Work:

-

Working before or after a scheduled shift

-

Skipping or working through unpaid meal or rest breaks

-

Completing job duties at home after hours

-

Traveling between job sites during the workday without being paid

-

Responding to emails, texts, or calls outside of normal work hours

-

Attending unpaid meetings, trainings, or company event

Off-the-clock violations also include time shaving or time clock rounding, where your employer adjusts your time records to avoid paying you for all the hours you've actually worked.

How Our Off-the-Clock Work Claims Attorneys Can Help

If your employer has failed to provide required meal or rest breaks, or hasn't paid you for work performed during those breaks, you have the right to pursue compensation for lost wages, backpay, and other damages.

At Josephson Dunlap, we represent workers nationwide in off-the-clock work claims and are committed to holding employers accountable when they violate wage and hour laws.

With experience representing over 100,000 clients across a wide range of industries, our legal team knows how to build strong, effective claims. When you hire us, we’ll collaborate with you on the following:

-

Gathering time records, communications, and other key evidence

-

Calculating your unpaid wages and potential damages

-

Negotiating aggressively for a fair settlement

-

Taking your case to court, if needed

We understand what’s at stake, and we’re prepared to fight for the pay you’ve rightfully earned.

Put an experienced legal team on your side; call Josephson Dunlap at (888) 992-2990 or reach us online to request a free and confidential consultation.

MICHAEL JOSEPHSON

ANDREW DUNLAP

RICHARD SCHREIBER

DAVID MATHEWS

OLIVIA BEALE

ALYSSA WHITE

WILL HOGG

JULIA CLINE

SCOTT STOTTLEMYRE

Can Employers Require Salaried Workers to Work Off-the-Clock?

Salaried employees are paid a fixed amount for a set number of work hours, rather than being paid by the hour. While they may not clock in and out like hourly employees, that doesn’t mean they’re exempt from wage and hour protections—especially when it comes to off-the-clock work.

Non-Exempt Salaried Employees

Non-exempt salaried workers are still covered by wage and hour laws, including overtime and minimum wage protections. That means:

-

They must be paid for all hours worked—even if those hours fall outside their normal schedule.

-

If they work more than 40 hours in a workweek (or, in some states, more than 8 hours in a workday), they are entitled to overtime pay.

-

If they are required to clock in and out, they cannot legally be asked to perform duties while clocked out without compensation.

Employers who expect non-exempt salaried employees to answer emails, run errands, or complete tasks after hours without pay may be violating the law.

Exempt Employees

For exempt employees (typically salaried professionals, executives, or administrative workers who meet certain legal criteria), off-the-clock work is more nuanced:

-

These employees are not entitled to overtime pay, and they often have more flexibility in how and when they complete their work.

-

However, if an employer imposes strict after-hours requirements that extend beyond the scope of the employee’s agreed duties or compensation structure, it may raise legal concerns.

-

In some cases, an employee may be misclassified as exempt when they should actually be non-exempt and eligible for overtime and off-the-clock protections.

Determining whether you're being unfairly required to work off the clock depends on how you’re classified, what kind of work you’re doing, and your compensation arrangement.

Submit your case in as little as 10 minutes.

Form Submission

Complete the form, and we'll connect with you within one business day. For a faster response, call us at (888) 992-2990 or click our chat bubble.

Free Consultation

A personal case manager will quickly identify if you have a case. A quick 10-minute phone call is all it takes.

We Build Your Case

Your personal case manager will work with you to make sure you have everything you need for a strong case.

Get Your Wages Back

Once your case manager has everything, you just wait while we fight for your wages. We'll keep you updated on your case results and when you can expect your money.

"*" indicates required fields